Bitcoin price is going to $1,000,000! ⚡ Jack Mallers explains why

There are two things I can guarantee you in my life. One that I’ll die and the other that there will only ever be 21 million Bitcoin. And those are what’s the two things that I can only value as my life and my Bitcoin. So it is the only fixed supply asset. Kelly, it’s not that complicated.

It’s going to go up because everything else can be issued more.

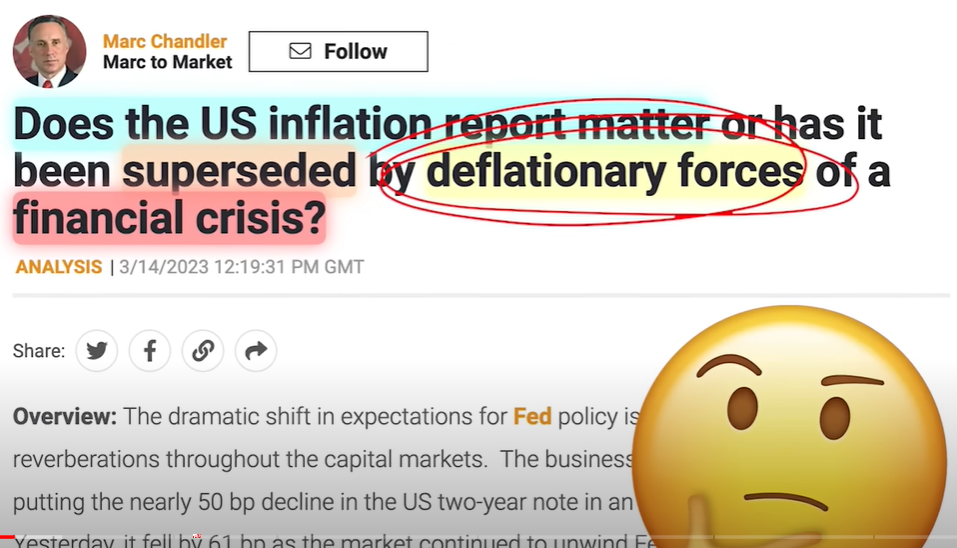

Jack Mallor, the CEO of Bitcoin payment app strike, says Belaji’s $1 million Bitcoin prediction is possible. Belaji’s $1 million Bitcoin prediction, however, is based on the US dollar going hyperinflationary. But the bank crisis is making the dollar deflationary or the 2010s, even with the massive QE, we didn’t see the US dollar go hyperinflationary.

But Jack Mallor says that it’s possible. A banking crisis is deflationary. And so when I see Belaji and others saying Bitcoin’s going to go to a million dollars, it may go up, but that may be because of the Fed’s response here. The 2010s were not hyperinflationary. There’s no obvious reason why now would be hyperinflationary, either.

Yeah. So Kelly, it’s, it’s actually not that complicated. And I’m excited to try and convey that to America. There’s a market term that’s used here in Chicago a lot is demand finds supply.

What do I mean by that? If Ken Griffin is going to want to buy the most expensive condo in America, someone will build it for him. Someone will put a 200 first floor in Miami’s tallest building. If silver is going to 1000 acts, I will walk into my kitchen right now. I will melt all my silverware and I will sell it at market. If gold is going to rally, Elon Musk will find more on Mars.

Bitcoin is this a super important point. Bitcoin is the only monetary instrument in the history of our species that is fixed. It does not matter how much more demand comes into the asset class.

Kelly, no one will ever be able to make more of it. There are two things I can guarantee you in my life. One that I’ll die and the other that there will only ever be 21 million Bitcoin. And those are what’s the two things that I can only value as my life and my Bitcoin. So it is the only fixed supply asset. Kelly, it’s not that complicated. It’s going to go up because everything else can be issued more. So if Bitcoin demand increases, supply cannot increase. It’s impossible.

But the Fed says everything is fine. The Fed says inflation is minuscule. Jack doesn’t think so. By the way, make sure you subscribe to our channel daily videos just like this, keeping you informed on the entire cryptocurrency market. If you’re interested in making money in cryptocurrency, subscribe to our channel daily videos. The only thing that’s clear to us and clear to our customers is you cannot hold and save in dollars anymore.

I think that there’s going to be a new era of the US dollar where inflation will enter a normalized five, six, seven, eight, nine, 10 percent. The days of 2 percent inflation are over. What if you’re wrong, Jack, because the market is, you know, the market is telling us we’ve gone from having, you know, expected three and a half percent inflation last year to just over 2 percent now for the next five years.

Again, it’s the op it doesn’t see inflation accelerating and picking up from here. Look at the swap lines we just instituted over the weekend. It re iterates the dollar’s dominance in the global financial system. And if anything, we’re going to be averaging inflation for the next decade. That probably looks a lot more like the 2010s, which just came from it was not inflation. And Bitcoin still did very well, by the way, it was not an inflationary period. What’s Jack going to say? Because she seems like she’s making sense. Inflation is being called, according to the Fed. Globally, the US dollar is dominant. The QE in the 2010s did not make the US dollar hyper inflationary.

Listen to how Jack answers this. Yeah, but Kelly, the swap lines in treating these assets at par that these banks are holding is a low to crap. It’s a politically correct way. The swap lines over the weekend were a politically, politically correct way going into an election year for the Federal Reserve to bail out foreign big institutions and not take care of the little guy in the United States of America.

Those things aren’t trading at par. If they’re trading at par when I walk down to my bank on the corner and I said, I want my money, they’d be able to hand it to me. They can’t, Kelly.

So this is just a masquerade load and nonsense. If you they have to backstop these things with new money and you’re seeing risk on assets, you’re seeing scarce assets actually be big winners here.

So you call it inflation because the CPI is a load and nonsense, right? Like the government’s going to tell me how the dollar is inflating based on a basket of instrument. Like my Netflix subscription or my Caesar salad doesn’t actually tell me how well the dollar is doing or how much it’s being devalued. Miami real estate does Bitcoin does Bitcoin’s up over 50% this year.

Yeah, you’re telling me that the dollar is not inflating. You’re out of your mind. I’m not listening to that. The Fed in the whole monetary system is based on trust and they constantly they constantly big break that trust. It’d be the equivalent of there’s a fire outside of my house. I smell the smoke and someone’s telling me, no, no, no, it’s just a bunch of teenagers putting on a bonfire.

Okay, but I hear one one siren. I hear one police siren. Yeah. Are you sure it’s bonfire? Yeah, it’s a bonfire. Now I hear 10 sirens, 100 sirens. Now my whole community is running out. I’m not going to get up and look outside the window, Kelly, and see what’s going on. I don’t believe them for a second. You’ve got to be absolutely crazy to believe the Federal Reserve right now.

They’re full of it. And I don’t have to because I own Bitcoin. There’s no one that could deflate my instrument. I get to hold it, save in it. I know the monetary policy. I sleep like a baby, like the baby face that I am. Jack, I think you’re crazy. Believe the Fed and these swap lines and treat these assets at par. It’s a gimmick. It’s a scam. It is fascinating to watch the folks on CNBC or Twitter assume that Bellaji’s bet that Bitcoin hits $1 million based on hyperinflation is asinine harmful to his reputation. They say or simply has terrible odds. Here is what they’re all missing. Given the latest financial crisis coupled with the stubbornly high global inflation.

Yes, not just us. The Federal Reserve and the FDIC have already backstopped a number of failing banks and have pumped copious amounts of dollars back into the system. The only problem headline inflation is still over 6%. When inflation is running three times higher than the feds target of 2%, injecting hundreds of billions, if not trillions of dollars of liquidity into the system is certainly not going to help promote price stability, aka help bring inflation back to their target. Yet the regional banking crisis requires a fix. Why? Regional banks make up the majority of mortgages in America as well as a huge share of consumer loans and other forms of credit.

If these banks cannot lend the economy crashes, big money center banks like JP Morgan lack the physical footprint in places like rural Oklahoma. So acquiring them will be doable but difficult and slow given how toxic the balance sheets are and the amount of time it would take to pour over them. So the feds in a tight spot. The only option is to print money and absorb underwater assets from these banks and in turn inflate the value of risk assets and inflation hedges.

Risk assets, right? Yes, that’s right. On a week when regional banks stock prices were crashing, the NASDAQ was up 5.83%. Risk assets tend to rise when liquidity gets injected into the system, but so does the value of inflation hedges, namely gold. Bitcoin has been widely accepted to be a digital form of gold, a hedge against hyperinflation. Unlike physical gold, Bitcoin is easy to buy, sell, transfer, hold. Nearly anyone with an internet connection can purchase it worldwide and nobody can print more of it. So what does this all have to do with Bellagie’s bit signal, the $1 million bet? He’s raising awareness to what is likely coming, an era of hyperinflation and hyperinflation happens fast. But wait a minute, there’s just one problem.

Why is the Bitcoin supply fixed? Because can’t it be changed? Subscribe to our channel for daily crypto coverage just like this. Engage with the video. Let’s get this info out there to as many people as possible. Listen to the answer that Jack gives to this question. You’ve got to explain to me one thing. Why is the supply fixed? And is that because someone says it’s fixed?

Who could change their mind? No, it’s a great point in question Tyler. It’s because it’s written in the software and the software is distributed. There is no one person to ask. There is no one person to trust. The whole decentralization is it decentralized so that you could put pictures and NFTs on the blockchain? Is it decentralized so that you could fix gaming? No, it’s decentralized so that the defendants of the monetary policy are distributed is so that it’s a network of computers that actually defend the policy and instrumentation of the monetary asset. That is not the case for Ethereum. That is not the case for any other altcoin. That is not the case for the US dollar. That is not the case for Miami real estate. That is not the case for precious metals. It is the it is the only monetary instrument that has its monetary policy distributed and defended and it’s found.

For me, Dan, spoken by if you say that that it’s because this is the way the software is written and it is immutable. It is unchained. Get your tickets to Bitcoin 2023, Miami May 18th through 20th,

Miami Beach this year. Use code altcoin daily 10% off. This is the biggest Bitcoin conference of the year. Ticket prices continue to increase as we get closer to the event. Use code altcoin daily 10% off. Get your tickets now. Why couldn’t the software be rewritten or why couldn’t the authors of the software or the guardians of the software write a new software that creates Bitcoin 2.0 with another supply of fixed supply of Bitcoin? Yeah. So Tyler, I run Bitcoin software and someone tried to do this. I want you to Google Bitcoin Cash after this interview is over.

Someone said, I want to change the rules of Bitcoin. I may want to create more of a supply. I may want to make it faster. I may want to make it do a backflip. I may make it want to store pictures of monkeys drilling on themselves on the blockchain and they created it and they created new rules and they called it Bitcoin Cash. It’s a different asset. It’s a different instrument. And when someone tries to pay me in it, my software rules that I run in my home in a room over there says, Nope, that’s invalid.

That thing is a piece of poop and I don’t accept it because it is invalidating the rules of the system that were set out by Satoshi Nakamoto over a decade ago. So you can create whatever you want.

You want to create Fed Now coin, flip a dukey coin. I don’t care. There’s 21 million of the things that I run and that I protect and that I save in and those rules were started a long time ago and that’s what the network runs. So if you change the rules, you’re creating a different monetary asset and a different instrument. It doesn’t matter.