Today we are discussing Bitcoin, Ethereum, and crypto in general.

Guys, crazy things are happening for Bitcoin right now, but if you think that the situation is fully over right now and that we are not going to have more swings, you are in for a surprise, because today we’re going to talk about the next big moves.

THIS BITCOIN PUMP IS NOT WHAT IT SEEMS

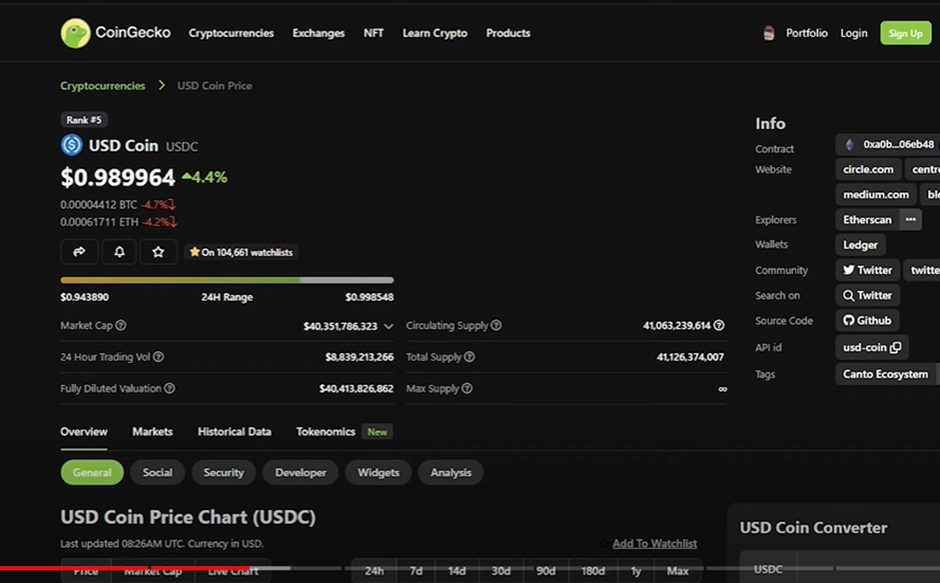

And recently, we’ve been talking about how the market was overreacting with USDC, how people were selling USDC for less than 85 cents, 86 cents. Those people are of course regretting it right now because USDC is going back toward $1. I’ll explain why in this video.

Also, we were talking about a bank bailout happening today. In my video yesterday, I was talking about a big move in 24 hours. That was 21 hours ago. We’re seeing that big move right now. And today, guys, I’m going to just like I said, prepare you for the next major move. So, guys, you will want to stick around from the beginning until the end. We’ve got extremely important things to talk about right now. Do not get caught off guard.

We’ve been discussing about how most people are wrong about USDC going down to zero people were comparing it to UST, the stablecoin Luna had completely different things.

And guys, lo and behold, look at this guy, massive pump for Bitcoin. We have pumped about 15% here from the bottom of this orange box here. And I just want to zoom out a bit and once again, say that once this orange box here failed us, once this was trying to hold up the Bitcoin price, failed to hold it up.

We went down. I was saying that we are most likely going to go down to the next level of support here. Now, would I think that the entire financial system basically was on the brink of collapse? Because make no mistake, that is actually one potential outcome. Had the government bailout not come yesterday, I’m going to talk about that soon. But this orange box was in the middle of this massive chaos in not only crypto but traditional markets, this orange box was still holding up the Bitcoin price, which is absolutely insane.

I have to say, this is not something that even I was and I know the strength of these orange boxes. But even if I did not build it, I couldn’t imagine that on the brink of almost an entire meltdown, potentially, this orange box was holding up the price. And we saw a bounce here. And of course, we did see a massive bounce of the triangle formation.

Let’s see if we can find some more momentum and break through this. And I will talk about some macro economical things happening, which could actually make that happen. But for now, orange boxes still giving us that magic in the market.

And guys, a lot of people are asking me like, how do you set up these orange boxes? Some people are also asking me like, can we get access to this particular chart so that we can have it in real-time all the time? And I have some news for you. I am going to set that up. I know I’ve been saying it before, but now we’re actually in the pipeline of creating that so that you can take advantage of it. Of course, this is going to, for the most part, be available for everyone. I will try to make as much as possible available.

So, make sure to subscribe and activate the bell in order to get that once it is available. For traditional markets, we can see we had a little bounce here in the future. Now going down a little bit, but crypto is really the one that’s having the biggest gain.

Okay. So, before we talk about the key things that happened yesterday and how to look at this moving forward. I know a lot of people have been making insane amounts of money trading this volatility. And if you want to sign up for the best exchanges and get the best deposit bonuses, you have the links in the description guys up to $30,000 on bibit and up to $50,000 on an ox.

So, make sure that they get that advantage of these offers in the description. Now let’s talk about what actually happened yesterday. When we’re talking about how the US government basically, they had like if they wouldn’t bail out the depositors, that could lead into a massive bank run and that could cause cascading effects on the market. So really the government and the Fed and whatnot, had to intervene. And yesterday they announced before the market opens today on Monday, of course, they said that the Fed announced that it will make available additional funding to eligible depositor institutions to help assure banks have the ability to meet the needs of all the depositors. So this is what the market wanted to hear.

So, the depositors are made whole, no one would lose money here. So everything was fine. And that means also the $3.3 billion that the circle has, which is the issue of USDC that is back in up the value of USDC, they will get their money back guaranteed by the Fed. That is fantastic. And also by the way, I need to remind you, even if we wouldn’t have a bailout here, remember circle initiated the withdrawal of $3.3 billion, which is a huge amount, I wish I could initiate withdrawals of $3.3 billion just like that. But they initiated that on Thursday, which means that they would still have that being processed on Monday today. Because yes, that was the condition basically with the FDIC every withdrawal that was initiated on Thursday, would be initiated on Friday or Monday.

So, they would still be eligible for that money. So at this point, there’s really nothing kind of saying that this should be below $1 right now apart from just people panicking, right? People just thinking, oh, could this happen again? I’m just going to get out and whatnot. But this is slowly going to creep back up until $1. This is what I believe previously. This is what I believe right now. And with this government intervention, there’s really no point in trying to short this or believe that this is going to go lower than where it’s currently at right now. But we have some other things as well.

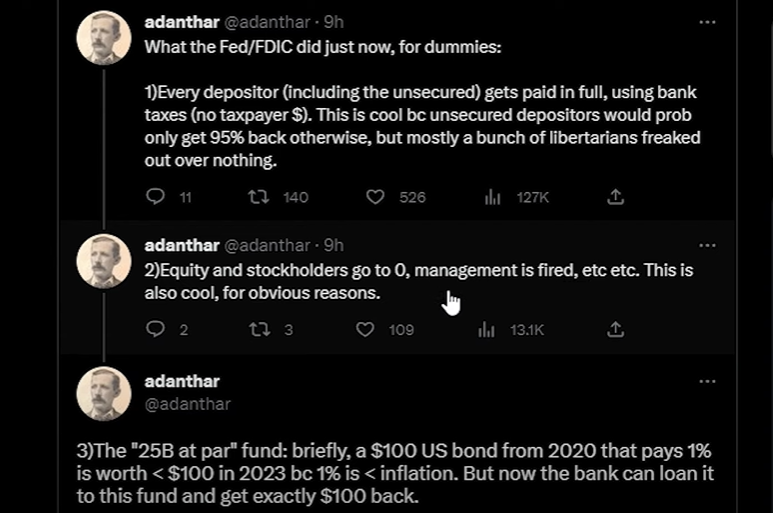

So, what exactly did the Fed and FDIC do right now? Well, every depositor, including the unsecured, gets paid in full using bank taxes, not taxpayer dollars. But this is cool because unsecured depositors would probably only get 95% otherwise. So you’re seeing equity in stockholders goes down to zero. So the people who own stocks in Silicon Valley banks, of course, go down to zero. They are not going to get that bailout because still the banks, they did a horrible job. Management is fired, of course, because they took on a lot of risks. Also, they are setting up a 25 billion par fund.

So basically, what this means, if you looked at my video from two days ago, where I explained how we ended up in the situation, to begin with, basically it has to do with government bonds that are yielding interest, they are worth less the higher interest rate goals. So for the bonds that were purchased in 2020, yielding 1%, they were worth, like if you invested $100, they were worth maybe like $60 today. And you would still get all of that $100 back, but it would take like 10 years or whatever. But it is still worth $100, just not on the open market.

So, what the Fed is doing right now is that they’re setting up kind of a lending situation here, where if you need to get access to cash, you can use your bonds. You do not have to sell them at 60% value, which is what cost Silicon Valley banks to go bankrupt. Instead, you can lend them back to the Fed, essentially, you get some liquidity and then you can process a withdrawal. So yes, this is something that is good because the value of the bond is still $100, just not on the open market.

And so when it was worth less than $100, they had to sell these for $60 on $100 value. And so that is how we ended up here. So yes, it means that the bank keeps operating payout withdrawals in the short term. Now long term, this is still a little bit of an issue but given like long enough time horizon, it should be fine. At least for now, the immediate danger of a massive bank run and banks becoming super liquid solves that problem. So short term, things are still looking good, or they are still looking decent. It’s not a like financial melting situation going on right now that could actually happen. This provides confidence in the market. Hopefully, things are going to be fine now. So, an update, but by the way, guys, the economy is still in a very weird situation where you have unemployment actually being not high, but you have inflation going up, you have interest rates being pushed up higher. But we will talk about that later.

So macroeconomically, this does nothing to help that situation. It just helps this kind of merging wildfire that was happening the last few days. Okay, I digress. An update on USDC by Circle founder and CEO Jeremy Allaire says that 100% of deposits from SVB are secure and will be available at banking open tomorrow.

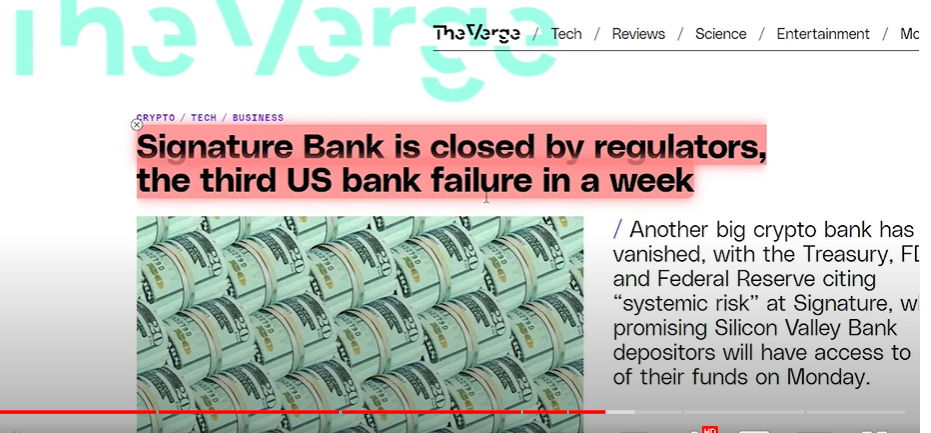

Now, another thing that the Fed did today and yesterday actually is they shut down Silver, or was it signature bank actually? So the signature bank was closed by the Fed. Now the signature bank is one of three banks that were serving crypto companies. You have Silvergate, which is already closed down and has been taken over by the FDIC. You have Silicon Valley Bank, which as we know, we know the situation already. And now the signature bank was closed down. But the same with the signature bank as with other banks, depositors are going to be made whole. So, no one will lose money on this. But these three banks were the biggest ones serving crypto companies. So, this is still a big blow to the crypto ecosystem as a whole, because you do not really have that big on rails for fiat money right now because the biggest banks are closed down.

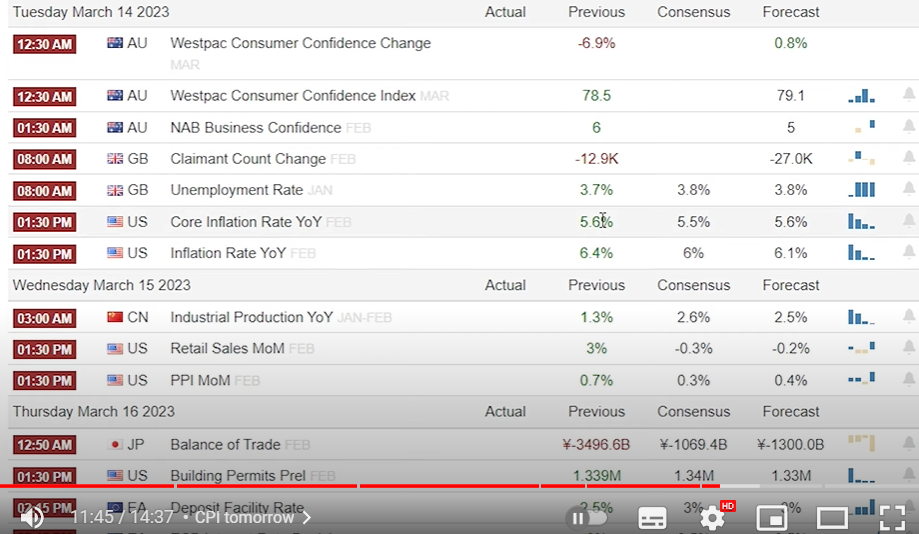

So, in a sense, and you know, I’ve been speculating that the US government wants to take down crypto, in a sense, they managed to do that right now. I mean, they didn’t take down crypto. Sorry, I have to rephrase that. But they want to make it harder to use crypto operation show point 2.0, not banning crypto, but making it harder for crypto companies to operate and just be in a hassle. And with the three banks that were serving crypto companies right now being shut down, well, I would say that they are in their eyes, at least, probably had a mission accomplished in that sense. But hopefully, other banks are going to step up now. Other banks are going to step up and hopefully fill that void. What else do we have? We have something major happening tomorrow. We have the core inflation rate year on the year coming out. We have the inflation rate year on the year coming out. And what are the forecasts 5.6% have 6.1% on the core.

So basically, the market is thinking that we’re not going to have a big change compared to the previous month. This is interesting because if you look at what the market was predicting the fed to do previously, they were predicting the fed to race rates by 25 basis points or 50 basis points. Now, in the midst of this chaos, the market is predicting with almost certainty that the fed is going to increase it only by 25 basis points, and no chance for 50 basis points, actually, a small little chance that the fed does not race it at all.

And why does the market react like this? Of course, because the reason why the banks or the catalyst for Silicon Valley bank and these other banks go into insolvency was that the fed was racing rates at an incredible rate. They were racing rates very quickly to curb inflation, of course, but this had disastrous effects on the balance sheets of these banks. So, of course, they are now going to have to be more reluctant on racing rates without breaking the system too much. And also, by the way, what we were talking about is the fed is going to stop racing rates when something breaks in the economy.

And we’re seeing things break in the economy right now. The question is, was this enough? Was this enough? Or are they going to continue to race rates? Potentially not this next meeting, but the meetings after that. This is what they’ve been saying, the fed had been saying that they’re going to continue to increase rates. So, we will see about that guys. On another note, this billionaire cryptocurrency exchange, finance, is now going to convert the remainder of the $1 billion industry recovery initiate funds.

So, this was, remember, in BUSD, and they are now going to convert it into Bitcoin, B&B, and Ethereum. So, CZ Binance is going to pump the market right now. So, these are the addresses. You can track it here as well. So, this is, of course, also having a positive effect on the market guys. As always, I am going to keep you updated. But for now, things are not looking too bad. The macroeconomic situation, we still have to watch it, of course. But when it comes to USDC, you can see it’s already at 99 cents here.

A lot of people made insane amounts of money by converting money into USDC at like 85 cents, 86 cents. But the most important thing is that USDC did not collapse. And USDC, I mean, there was never a danger of USDC going down to zero. If you know, if you’ve been watching my previous videos, you know why it was never a danger for it to go to zero. But for it to regain that $1 peg is very extremely important for the market right now. So, it was unpacked for a couple of days. Now, creeping back towards $1. I want to see this at $1 by the end of today, guys. Okay, that’s what I got for you.