40K BITCOIN?! (THIS is about to PUMP Bitcoin!!) MASSIVE SIGNAL CONFIRMATION TODAY!

This week is going to be a massive week for Bitcoin and for cryptocurrency. And today, when the weekly candle closes, we are going to have 100% confirmation of a massive signal that is printing right now. We are going to be diving deep into the charts.

Market capitalization has gone up quite a bit during the past week. Since the news of Silicon Valley Bank going under, we have seen about $160 billion come into Bitcoin. What does this mean?

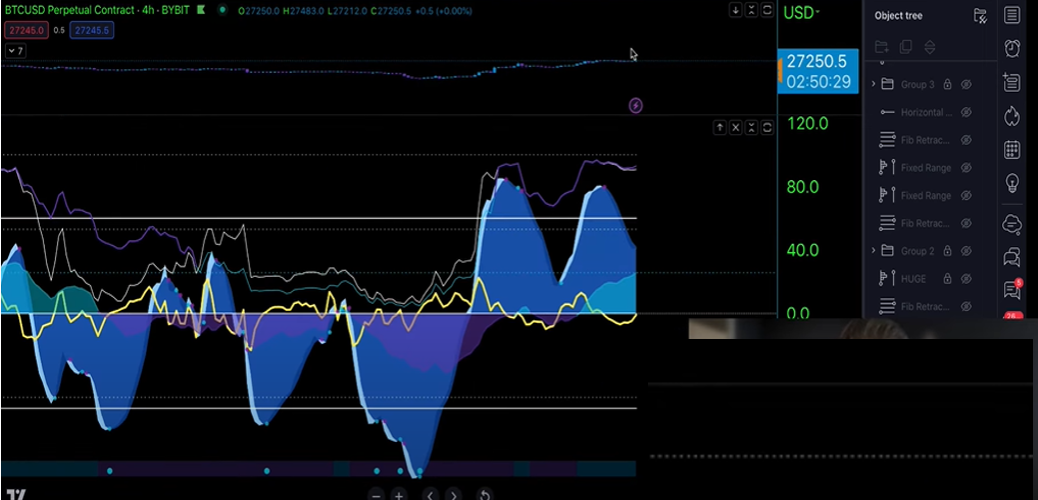

This means actual money has been driving the price action upward. This is not a short squeeze. This is not some kind of weird anomaly. There are billions of dollars flooding into Bitcoin right now. And we have seen a 42% increase in the total amount of money that is coming into Bitcoin. Why is this so important? People are concerned about the banks collapsing. People are concerned about stable coins collapsing and Bitcoin is starting to be seen as what it was originally meant to be a safe haven from the current corrupt financial system. And when we take a look at the Bitcoin chart, we also see on the weekly timeframe, money flow is coming up on this weekly market cipherb. We are seeing the purple money flow start to cross into the blue, which is a very, very powerful signal. When we get weekly money flow crosses on Bitcoin, as we did back here in March 2022, it marked the beginning of a massive move to the downside.

Basically, it marked the beginning of a 53% move to the downside. So, we can imagine what will happen when the money flow crosses back into the blue. And when we take a look at these lower timeframes like the four hours, even as we consolidate here, printing slightly bearish divergences on this four hour timeframe, look at the money flow right now. The money flow is getting very, very thick on the four-hour market cipherb. And when money flow gets very, very thick, and we start to print green dots around this area, it can actually give us very, very powerful moves to the upside.

So when we just zoom out and look at this chart, we can see that yes, this is a bullish chart objectively speaking, when we go to the weekly timeframe, we have now been putting in higher highs and higher lows since November, our low are high, our higher low, our higher high, our higher low and our higher high, officially now taking out the previous higher high on the weekly and the monthly timeframe, we have officially flipped into bullish market structure on the weekly timeframe. And basically, when we are in bullish market structure on the weekly timeframe, this means there is more probability that we go more to the upside than to the downside, right?

If we were trading us on the one-hour timeframe, we would look at this and say we have officially broken market structure, we can now look for the higher highs and the higher lows to continue. In addition to that, we are officially breaking out of some massive zones of resistance. We have the 200-week moving average coming in right now at around $25,420. If this weekly candle can close above the 200-week moving average, I believe we are going to see a massive push to the upside. More than what most people are expecting. Now, a lot of people are still remaining bearish. We do have the FOMC meeting later on this week. We’re going to be talking about that. But in addition, we have this very, very key trend line that Bitcoin is also breaking out of and retesting right now. This was our resistance at the all-time high. It was our resistance at the April 2022 high. And then we have broken out. We have retested it on the weekly with a very, very bullish wick. And now we are getting a very big bounce to the upside.

Okay. This is very, very important right now. When this weekly candle closes, in my opinion, that will be confirmation of a macro Bitcoin trend reversal. And again, the reason why I maintain so much of a bullish bias right here is because not only are we seeing resistance as being flipped to support, but we’re also seeing the money come into Bitcoin. And in addition to that, all the supports that we are coming back down to in these pullbacks have been very, very short lived, right?

We gave the level in the Casper crew VIP discord from 19 5 5 2. That’s the swing long trade that I am currently still in right now. We gave the long from 24 0 3 1. We gave the long from 24 650 is. And all of these long trades that we gave in the Casper crew VIP discord, these supports have been holding with quick bounces. And by the way, if you want to join the Casper crew, where every single day we give our trade setups, we give our levels, we do three life streams a day, you can go to patreon.com for slash Jason Casper and to take advantage of trading on by bit with 0% limit fees, make sure to click the link in the description of the video because it’s actually a really, really good deal for people who want to trade on by bit without having those fees cut into your profits. This is great.

If you are trading on the lower term timeframes like we often do in the Casper crew VIP discord. And yes, you get 0% limit fees for derivative contracts. Also, if you deposit $100, you get one month free of our tool, the crypto fusion trading button guys, if you don’t know how to trade, please don’t sign up on by bit. This is not a get rich quick scheme. Trading is not a get rich quick scheme. You’re not going to get rich in the bull market trading on by bit.

If you don’t know what you’re doing, right? This is an accumulate and growing account slowly over time scheme. And if you want to learn how to do that, check out the course. There’s a 20% discount in the description. This will teach you how to do this. Right. Okay, so this week, very, very historic FOMC meeting. The Fed is going to be announcing the new rate height. Are they going to rake?

Are they going to hike rates at all? Right now, if we take a look at the, um, CME group market watch website, we can see that 38% of people are expecting that the Fed is not going to raise rates at all. And 62% are expecting a 25 basis point race. This is huge because due to all the banks collapsing, the Fed once again is in between a rock and a hard place.

If they don’t want the banks to keep collapsing, they’re going to have to bail out these banks somehow, right? Which somehow means they’re going to have to put money into circulation that wasn’t into circulation before. And the first step of moving in that direction is to stop raising interest rates.

Now, it’s a give and take for the past year. The Fed has been raising rates to lower inflation. But the problem when you raise interest rates, first of all, it creates a stronger dollar, which makes Bitcoin and stocks go down in value because we’re comparing everything to the dollar. So if the dollar gets stronger, that means other assets when compared to the dollar are going to go down in price. It lowers inflation when they raise rates, but it also gets banks wrecked.

Okay? Banks get wrecked when interest rates go up, they lose money. Now, on the other side of this give and take is printing money and stimulating the economy. This keeps banks afloat. This is how the Fed bailed out banks in 2008, 2009 by basically stimulating the economy, giving a bank’s money when banks didn’t have money. This increases inflation, which means the value of the dollar goes down. But when we’re comparing risk assets to the value of the dollar, those things will go up.

Think about it. If one dollar has less purchasing power, that means it will take more dollars to buy something. So if we’re looking at Bitcoin and inflation is going up, meaning the dollar is getting weaker, that means it will take more dollars to buy one Bitcoin, aka the price of Bitcoin goes up. Right? So this is very interesting. If the Fed decides not to raise interest rates, this could be the added juicy secret sauce to our massive bullish scenario that could really push Bitcoin to some crazy price targets. Okay? Very important. Now, when we take a look at the dollar, we can see something that is very crucial. The dollar right now is sitting at this 103-509 level, which is the top of a channel that we have literally been trading since December 2014.

What does this mean? If the dollar is going to become weaker, if the dollar is going to go down in value and we come back down into this range, it’s more probable than not that we see the dollar actually come back down to the key zone of support. And we can look at this as just a bearish deviation outside of the range. And now we’re going to come back down into the range very similar to the Bitcoin chart, where we have been trading this channel on the Bitcoin chart. We could look at this as a bullish deviation below, and then we come back in and fill to the upside, right?

The dollar is inversely correlated to Bitcoin. When we have a weak dollar, we have a strong Bitcoin and vice versa. And when the Bitcoin hit its all-time high, the dollar was trading down here at the bottom of the range. April 2021, the top of the Bitcoin bull cycle was the bottom of the dollar, right? Now we’ve seen Bitcoin, the bear cycle has bottomed out according to many high time frame indications. And we’re basically seeing the dollar is ready to fall back down into its massive range.

Bitcoin is ready to pump back up into its massive range. And it really depends a lot, in my opinion, on what the Fed does this Wednesday. If they raise rates, we might not see as much of a bullish move. But here’s the thing. I look at no matter what happens right now as a bullish scenario for Bitcoin. And here’s why. If the Fed does raise rates, we’re going to see more banks go under, and more people are going to be putting their money into crypto. Because if banks are going under, people are not going to want to keep their money in crypto. That is bullish for crypto.

If the Fed stops raising rates, that is bullish for crypto. Because we are going to see the dollar get weaker, and people are not going to want to keep their money in dollars. They’re going to be looking into crypto for a safe haven. I kind of look at this as a win-win situation. Of course, we’re going to have to wait and see how this plays out. Guys, this is very, very juicy times that we’re in right now. So we need to be paying attention to these charts. These are historic times.