07/03/023

Bitcoin vs Ethereum? BEST Investment? Whales BUYING!

Bitcoin or Ethereum? That’s the question. What are the whales buying? Which coin will have the best returns going forward from this year into 2030?

*I ask you, when it comes to best returns from the two biggest high caps, Bitcoin or Ethereum. Let’s do a deep dive on Bitcoin versus Ethereum, and understand where they each stand today to answer that question by the end of the artic.

- Ethereum is in such an interesting place today. While the network activity increases, the ETH supply decreases. This makes Ethereum deflationary. Really amazing when you consider how Ethereum first started. Vitalik, the creator of Ethereum, got into crypto because Blizzard, the company behind World of Warcraft, nerfed his character.

- Quote, I happily played World of Warcraft from 2007 to 2010. Vitalik Buterin writes in his bio. But one day, Blizzard removed the damage component from my beloved warlocks, siphon life spell. I cried myself to sleep, and on that day, I realized what horrors centralized services can bring. I soon decided to quit. Vitalik got into Bitcoin and soon after started Ethereum. So Ethereum is eight years old now, and eight years later, we have so many daps booming on top of Ethereum, taking supply off the market. We’ve seen DeFi, we’ve seen NFTs, just to name a couple. Many people are saying that blockchain gaming is the perfect fit.

* And blockchain games are the next big thing in the gaming world and the crypto world, just like NFTs in 2021 and DeFi in 2020. And that makes sense, right? That’s the original reason Vitalik was inspired to get into crypto and build Ethereum because of a game.

* I think gaming in FTS in general just makes a lot of sense. It was the entire reason why Vitalik started Ethereum, by the way. Vitalik used to play World of Warcraft, and one day he noticed that one of his favourite characters got weakened by Blizzard, the developer of the game. And that’s when he realized the danger of centralization. And at least that was his version of the Genesis story of Ethereum.

* And so it makes sense to turn those in-game assets in World of Warcraft into NFTs, that the game developer has no way to really affect. Obviously, it’s much harder than that, because the game developers can potentially do other things today in FTS, right? Like they can change the entire game loop in a way that basically older in FTS become less relevant in the new game loop. But at least that’s the hope, that’s the promise of turning in-game items into NFTs that the users truly own.

* Before we jump into Bitcoin, let’s get a final summation. Where is Ethereum today? Ethereum supply is declining with rise in network activity. Let’s go into more detail. With the adoption of last year’s recent upgrade, EIP 1559, the Ethereum network has become a deflationary asset since mid-January this year.

* This upgrade permanently removes a percentage of the transaction fees from Ethereum’s circulating supply each time an ETH transaction is sent. The more adoption, the more interest, and the more trading volume the ETH network sees, the scarcer the asset can become. This has caused a decrease in overall supply of Ethereum this year. Since the upgrade was merged into Ethereum 158 days ago, 28,000 ETH worth 48 million has been burned forever taken off the market.

* Supply and demand? This is good. So going forward, Shanghai upgrade and Ethereum development. The Ethereum network is now preparing for the Shanghai upgrade, another significant upgrade that is expected to occur next month. This upgrade will release 25 billion worth of Ethereum that has been locked in early staking contracts. Note, this Ethereum after the Shanghai upgrade, which cannot become unstaked, doesn’t all get unstaked at once.

- You don’t have to unstake if you don’t want to. And long-term, I would say this is actually bullish because this will give people entities more confidence to stake their ETH going forward, now that they know that they can unstake it. After the Shanghai upgrade, the Ethereum developers will focus on implementing new features such as charting and zero knowledge proofs.

- Well, what are those? Charting will enhance the blockchain’s scalability by allowing the network to perform parallel processing. This feature will improve the speed and efficiency of transactions. Zero knowledge proofs enable enhanced privacy by allowing users to authorize transactions without revealing any identifiable information. Let’s take a look at Bitcoin and compare it to Ethereum.

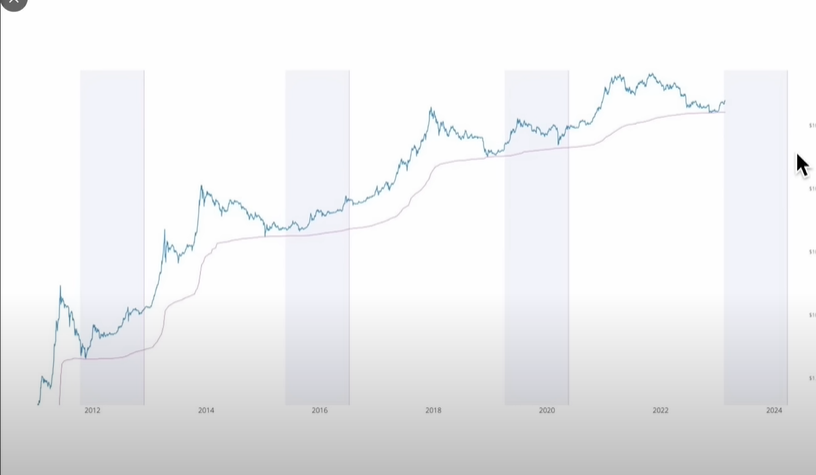

- And let’s start off simple because simple is powerful. Here’s the timing of Bitcoin cycles. Here’s the timing of Bitcoin cycles. Probably means we are entering into a reaccumulation phase of the cycle.

- Here is the past reaccumulation phases. And as you’ll notice in each reaccumulation phase, slowly grinding up, slowly trending up. It’s interesting though, the number of Bitcoin whales has dropped to its lowest level since 2019. The number of Bitcoin whales or wallet addresses holding 1000 Bitcoin or more hit its lowest level since August 2019 on Sunday.

- There were 2,027 whales on Sunday, February 19th. The last time their numbers dropped this low was August 5th, 2019, when this number was 2,023. Owning that much Bitcoin at its current price, around 25,000 represents a sizable show of faith in Bitcoin with each whale holding almost 25 million in Bitcoin.

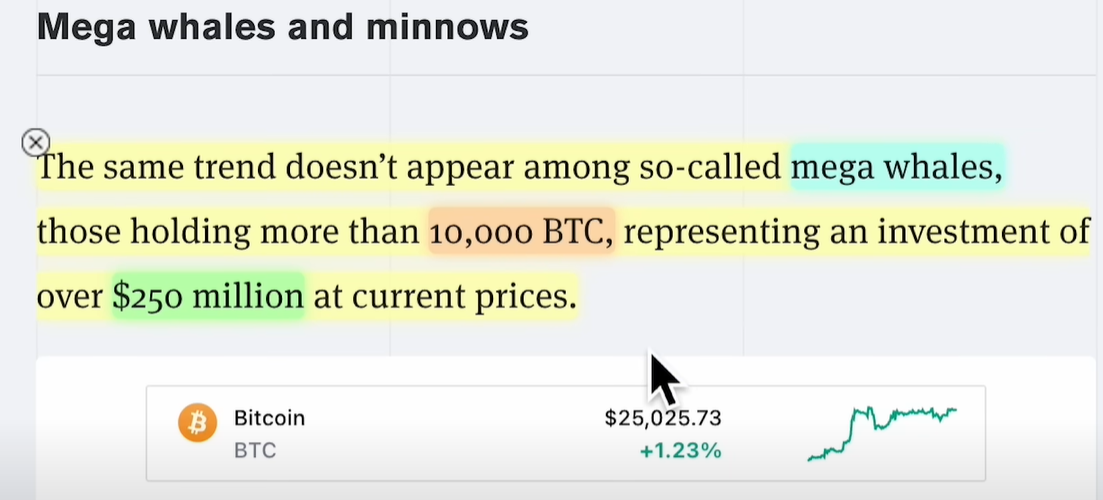

- What about minos? What about mega whales? Well, the same trend doesn’t appear among so-called mega whales. Those holding more than 10,000 Bitcoin representing an investment of 250 million at current prices. There are just 117 mega whales, which is actually fairly close to historical highs of 123, November of 2022 and 126 in October of 2018. So mega whales are near all-time highs. And then the number of smaller investors in Bitcoin while it’s holding over one coin has actually increased as well, gradually increased over the past five years.

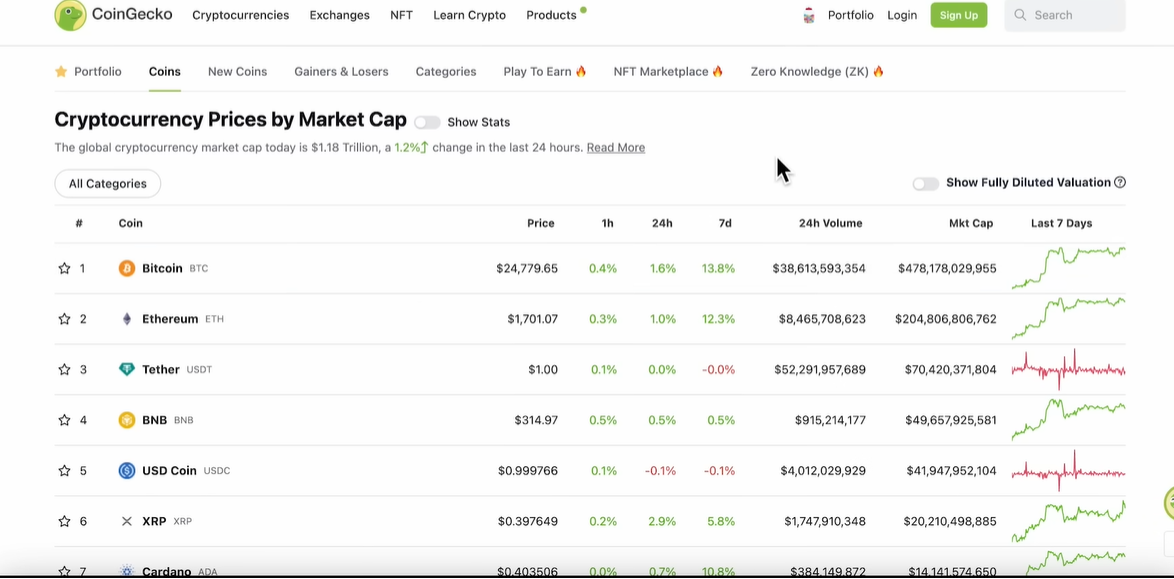

- So Bitcoin whales dropping to its lowest level, mega whales near all-time highs, minos, trending up for five years. How’s that compared to Ethereum? Well, it’s hard to compare them exactly.

- The data shows, however, that sharks and whales, so ETH addresses holding 100 to 100,000 Ethereum, are still holding near 47% of the supply, and seems to be relatively strong. But Ethereum has NFTs, right? I mean, I don’t know if you saw this, but NFT marketplace is competing.

- Blur overtakes Open Sea as Ethereum NFT trading skyrockets. Ethereum has NFTs, that surely gives it an edge versus Bitcoin, right? Oh, but wait, Bitcoin has ordinals now. Ordinals launch on Bitcoin Bitcoin NFTs.

- Because of Bitcoin NFT ordinals, more people are running nodes, more people are using taproot, more people are using lightning, more people are competing for Bitcoin block space, all because of inscriptions, all because of ordinals. You truly love to see it. But of course, Bitcoin does have big advocates, like Michael Saylor, breaking news Michael Saylor buys more Bitcoin with MicroStrategy Fund. The whales are back. Michael Saylor raises a whopping 46 million in share.

- Sales for MicroStrategy, the share sales hint at potential Bitcoin purchases in the future. Saylor is still bullish on Bitcoin in its capacity to make global economic change. But then of course, Ethereum seems to be getting some big advocates as well. YouTube’s new crypto-friendly CEO sees incredible potential for blockchain and NFT tech, to boost viewership and reward influencers. Now, of course, he didn’t say Ethereum specifically, and of course he could be talking about it or a centralized blockchain, maybe a salon, maybe a flow. But still, I think any of this hints at a bullish future for Ethereum.

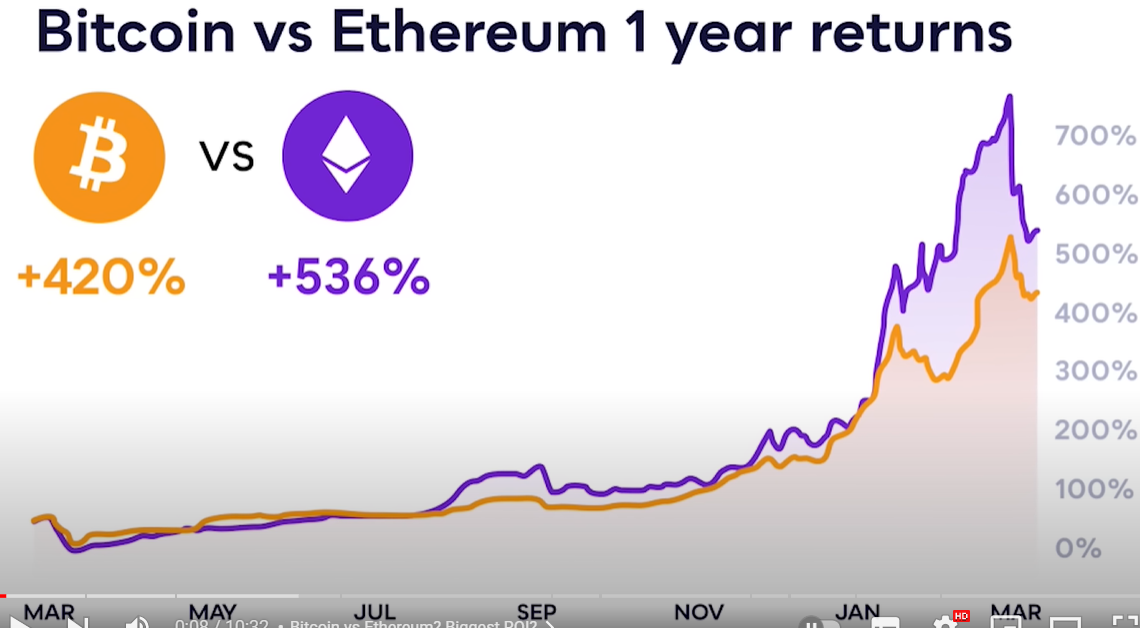

- So let’s talk about it. Which cryptocurrency between just Bitcoin and Ethereum is the better investment going forward? What’s going to provide the biggest returns? And let me just say off the bat, and you might know this, if you subscribe to our channel, I own both Bitcoin and Ethereum. I like them both. And they’re different, right? And that’s actually why I like them. They’re not just ones, not just derivative of each other. They’re very different. For me personally, I own more Bitcoin than Ethereum. However, in the past couple of years, I’ve been dollar-cost averaging more into Ethereum than Bitcoin. I know you don’t want to hear this, because everybody just wants to hear only this or only that. But I do think they’re both necessary in a cryptocurrency portfolio. And then to be completely real with you, I think Ethereum is a lot different than any other point in Ethereum’s history. It is a lot more stable. It is a lot more secure, and its roadmap is pretty clear. I think Ethereum will have bigger returns than Bitcoin in the future for the next couple of cycles. Just my opinion could be wrong. If any of us near the future, it’ll be rich. I do own more Bitcoin than Ethereum. I have been cost-averaging more Ethereum over the past couple of years. And I do think Ethereum will have bigger returns over the next couple of years. Now, you tell me what you think.