Mark Yusko’s Prediction: The Next Bitcoin Bull Run Is Upon Us!

A week ago, everyone was freaking out, right? SBB, you know, Friday, everyone was freaking out. And I put on the Bitcoin orange pants. I put on my Genesis block socks. And I said, look, look what it says, right? Chancellor on the brink of second bailout for banks. Bailouts are good for Bitcoin and for crypto. And sure enough, and we saw it in 2020, right?

We printed half of all the money. This existed in the history of our Republic,

247 years, half of it in an 18-month period. Well, gold should have doubled.

But it didn’t. But the other asset did double. It almost perfectly doubled from 10 to 20,000, exactly as you would expect. That was Bitcoin.

After months of extreme price volatility, Bitcoin moved to a fresh nine-month high on Friday. The top crypto asset smashed $27,000 and gradually began to close in on $28,000. The rally follows the US Federal Reserve’s decision to create an emergency lending facility equipped with $152.9 billion to backstop embattled banks in the country.

Through this discount window, the central bank will accept underwater securities

from the embattled banks at market value. The $152.9 billion is in addition to the $142.8 billion entrusted to the bridge banks for Silicon Valley and signature banks.

Altogether, the Fed’s balance sheet is grown by $298 billion, essentially reversing

the quantitative tightening efforts of the past four months.

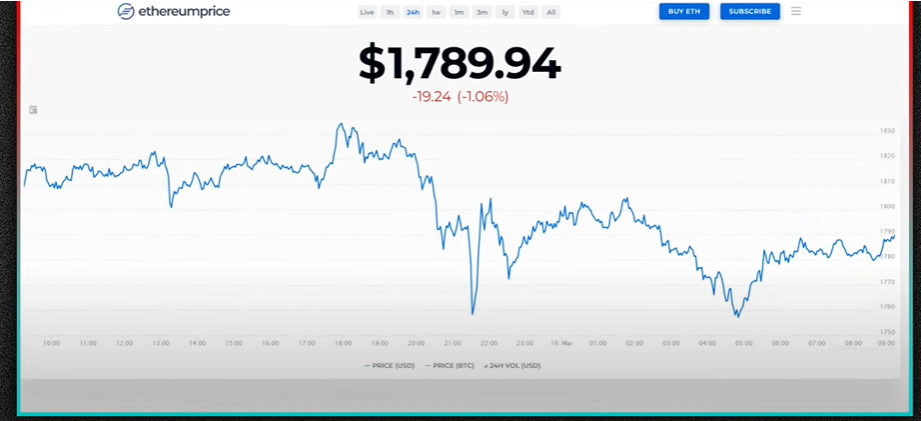

As expected, the Fed bailout started an impressive rally in the cryptocurrency markets. Bitcoin has gained over 33.56% in the past week and is currently trading at $27,199. Ether, the second largest crypto by market cap, has also gained 22.17% in the past week and around 4% in the past 24 hours. The largest altcoin is now exchanging hands at $1,789 according to data from Coin Market Cap. In a recent interview with Real Vision Crypto, a popular American investor and hedge fund manager, Mark Yusko, discussed the widespread banking crisis, the Fed’s bailout plans, and how it would impact Bitcoin and the overall cryptocurrency markets.

During the interview, Yusko recounted past financial crisis, including the great financial crisis and the timely creation of Bitcoin. Yusko expects Bitcoin to begin to outperform within the coming months, as it has always done during previous

bailouts and periods of economic expansion. Before we take you to Yusko’s interview,

I think there are so many things to talk about here. One is, you know, this crisis,

and people are calling it a crisis, is very different than the global financial crisis.

And the core reason for that is the type of assets on the bank balance sheet. So if you think about a bank balance sheet, there’s the green. So it’s St. Patty’s Day,

you’ve got the green side assets, things that, you know, derive value for the bank.

Then there are the liabilities, the red. And the liabilities are actually our assets, right?

We put our money in a bank and it becomes their money. It’s one of the things that people don’t really think about. It’s no longer your money. It’s theirs.

And you have an IOU that is money good most of the time, but those liabilities,

and in a perfect world, the assets, which are the loans that they make or the investments that they make, a creep value, and the green becomes bigger than the red, and it leaves you with some gold.

Potty gold. And gold is the equity of the bank. And in a normal functioning system, that gold grows as the green expands, and people can get access to their deposits. If you think of what a bank does, it takes the deposits of everybody, the community puts their deposits in, and then it takes those deposits and makes loans. And those loans could be the form of a mortgage. We’ve all seen it’s a wonderful life, where it’s about the building a loan, and building other people’s homes. It could be loans to businesses, so they can buy stuff or build products. But it can also be investments in yielding assets, like bonds.

Then we had 1987 problem, where we had bad people doing bad stuff, like literally stealing money. So that was bad, and if you steal the assets,

and if your assets, the green shrink to smaller than the red, and people then try to take their money out, there’s no gold, right? Gold disappears. So Charles Keating and all those guys, they did bad stuff, and people went to jail. And then we had the global financial crisis. What was the global financial crisis? Well, the green was not so green. They made loans to, you know, imaginary people, and people’s third homes, and interest-only loans, and all kinds of crazy stuff that was never going to get paid back. And so again, the gold disappeared, and it had to be a bailout, which is why Bitcoin was born. When a banking crisis happens, when there’s a loss of confidence in a banking system, basically you vaporize the gold, right?

You vaporize the value, the money at the base layer of the system, and therefore the currency, the credit, because the only money in the world, Ash, and you and I have talked about this, is gold, right? Money is an asset that exists in the absence of a liability. That’s gold for 5,000 years. Now I’ll argue it’s Bitcoin for the next 5,000, but let’s just say it’s gold. And everything else is credit. JP Morgan famously said, gold is money, everything else is just credit, or debt.

And so what happens is, when you lose confidence, then all of a sudden, the value dissipates, and you have to devalue the currency by printing more of it, by fiat. And so that fiat fiasco, as I like to call it, my hashtag fiat fiasco, that goes on over and over and over again, is when governments that overspend, banks foment that and facilitate that, and then you have to pay the piper and they can’t, so they just print more money.

And we saw it in 2020, right? We printed half of all the money, this existed in the history of our Republic, 247 years, half of it in an 18-month period. So what should have happened? Well, gold should have doubled. But it didn’t. Why not?

Well, because JP Morgan’s been spoofing the price, and that’s a whole other story for another day, but the other asset did double. It almost perfectly doubled from 10 to 20,000, exactly as you would expect. That was Bitcoin. Because Bitcoin, one Bitcoin is one Bitcoin. One Bitcoin is one Bitcoin with different currency representations all over the world.

During the interview, Yusko explains that Bitcoin never gets bear markets in countries of Venezuela and Turkey, where their currencies have been on a constant decline for a while. This is probably the biggest selling point for the world’s largest cryptocurrency. Bitcoin, Maxis, and other crypto enthusiasts have always advocated that the crypto asset is the only permanent solution for eradicating the widespread currency debasement.

Let’s get back to Yusko’s interview, as he further discusses the banking crisis and what’s to come. I got the sign behind me, says, buy Bitcoin. One Bitcoin is one Bitcoin, but we don’t price Bitcoin and Bitcoin. We price Bitcoin in dollars. Other people price it in euros or yen, or Argentinian pesos or Venezuelan boulevards.

There’s never been a bear market in Venezuelan Bitcoin prices, not ever, or Turkey for that matter, because the lira just goes to toilet paper. We’re not in a crisis of bad things being done and dumb decisions like we were with CDOs and CDO squared and financialization.

We’re in a government-mandated mismatch of assets and liabilities, yes. But again, if I hold those assets to maturity, I’m getting paid. That is a very different thing than lending somebody’s beach house interest only in a place where nobody goes anymore. That property is going to go down in value, and you’re going to lose money on that loan. I struggle with a couple things.

I struggle with one. Why do people feel the need to incite a bank run? Bank runs bring up this whole age-old thing about, you know, I hear the Bitcoin Maxis and others saying, you know, fractional reserve banking, it’s a fraud. It’s a fraud from day one.

You know the day one that company is bankrupt. Like, OK, time now, stop. I asked this question to challenge anyone listening, OK? Name a country that either does not have or has a poorly functioning fractional reserve system, banking system, that you would move to today. Oh, wait. Can’t do it. But it separates the great countries in this world from the lousy ones. And by lousy, I mean, tough places to live, dictatorships, et cetera, is well-functioning fractional reserve banking. When the community comes together to pool risk and create wealth and innovation by funding businesses and asset ownership collectively, through fractional reserve banking, the world is a better place.

Now, can it be abused? Can it be manipulated? You know, there’s a reason the Rothschild family is their wealthiest family in the world, right? The wealth of the Rothschild family, single family, now it’s a big family, like big. The bottom three quarters of all the people in the world. Same well. Well, one family, three quarters of people on the planet. Okay. So it can be manipulated for gain, but the good that’s done, by fractional are banking, off this charts.

Yesco is not the only one optimistic about a Bitcoin bull run. On Saturday, after Bitcoin regained the $27,000 level, popular anonymous analyst plan be also hinted at a new bull run in one of his tweets. The tweet reads, Bitcoin bouncing back towards the dark blue area of the stock to flow valuation model. Hey, or love it, the housing is coming. Triple top, new all-time high, and the current cycle is not impossible.