BITCOIN HOLDERS – The Biggest Fed Meeting in History Happening NOW!

(Be Prepared)

Why is Bitcoin going up? Will cryptocurrency crash again in 2023?

Yeah, so the feds in an interesting spot right now because the whole idea is that they’re going to hike until something breaks, right?

That’s been the story of 2022 and, you know, my general expectations have just been that the terminal rate is going to be around 5%.

I’ve said I think they’re going to make it to at least 5% to continue to hike too much further is likely going to put too much pressure on the economy and could easily start to break more things.

.

Today is a down-to-down, quant analyst Benjamin Callan, and we discuss possibly the biggest federal reserve meeting happening today and tomorrow with results coming in in the 22nd.

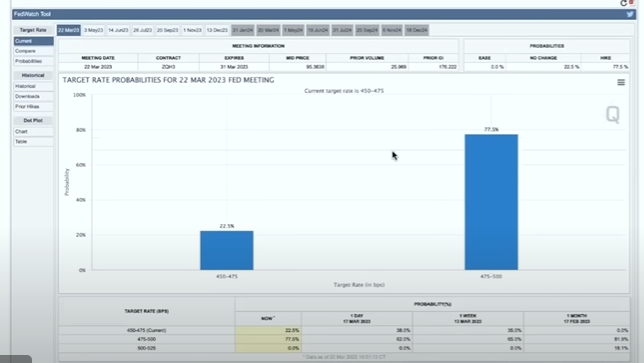

Now, we’ll take you through some charts, we’ll talk about Bitcoin specifically, but first, with the current federal funds interest rate right now between 4.5 and 4.75, will the Fed raise interest rates again, and what is the market predicting is the most likely increase?

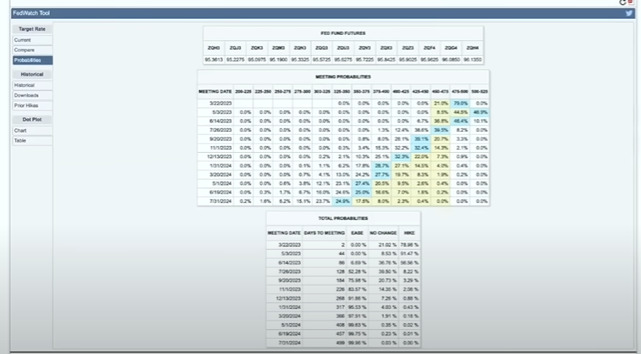

Currently, the market is suggesting a 77% chance of a 25 basis point rate hike, but what’s more interesting to me is a couple of different things that I think we should look at, and that’s actually what does the market expect going forward beyond the next rate hike or the next two rate hikes if they want to do a couple more rate hikes.

And what’s interesting is that the market is suggesting that the Fed’s going to cut rates as early as June, which goes very much against what what Jerome Powell has told us, in that they’re likely not going to be cutting rates this year.

I think if they do cut rates this year, it’s probably going to be at the end of the year, or let’s just say early 2024, which would be kind of nice because it would correspond to the Bitcoin having.

And hopefully we could just, you know, see everything stars align once again. But what this I think should tell us is that the market does not believe the Federal Reserve right now.

And the reason is because of what recently happened with the banks and the Fed having to backstop, you know, all these deposits to make sure there’s not a run of the banks. But what happens though, if Powell comes out on Friday or on Wednesday and says, we’re going to go higher for longer again, you know, what happens then.

And I think there could be some consequences of that of the market than having to reprice in higher for longer for like the fifth time because we keep getting to this point where the market believes Powell and then they don’t.

And finally, before we go over the Bitcoin charts, what is the most likely scenario tomorrow? Why is Jerome Powell stuck right now between a rock and a hard place raising probably just 25.

I know there’s been some speculation as a 50-basis point rate hike. I don’t think they’re going to go 50. I think that it’s too much for the market to handle and I think they probably know that.

But I also think going zero would send the wrong message is is is my concern I think going with zero would send the wrong message especially with Powell at the last at his congressional testimony last week, saying that they might even increase the pace of rate hike so to go from saying they might increase it, then doing zero might be too but too much of a move so I think they’re likely going to go with 25.

So the question becomes, how many more times will they do it right is it going to be another one and another one is I just going to keep going on. And how long will that go on for, and then ultimately how long will they keep rate hikes or the fed funds rate at that level?

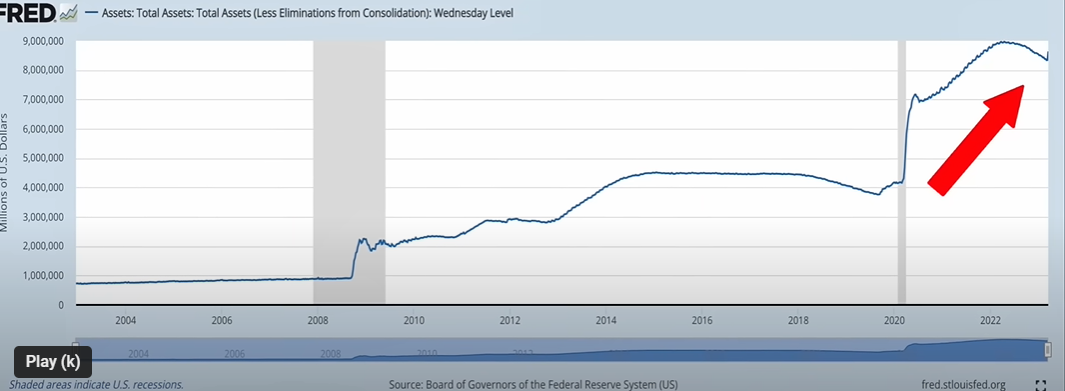

So that’s really what I’m looking at this week and I think the other thing that we need to look at at the Fed meeting is is the actual probably something that doesn’t get talked about nearly as enough, nearly enough is the is the actual quantitative tightening part of what they’re doing and that’s rolling off assets from the balance sheet.

You know, not just letting the bonds mature, not renewing. And, and so far, you know they’ve been doing less than a billion per month for quite a long period of time or around those levels.

But what happened last week they raised the ballot sheet went up by 300 billion. Thanks to thanks to having to come to the rescue of the bank so I wouldn’t be surprised my expectation is a 25-basis point rate hike with a with a hawkish tone to try to keep the markets down from assuming it’s an outright pivot.

I think that’s what we’re likely looking at. And potentially one way to send that message would be to increase the rate of QT, which is not the interest rate right not not increasing the interest rate above 25 basis points, but potentially increasing the rate of the quantitative tightening side of things and actually rolling off at more assets from the balance sheet than they previously were.

And based on all of this today, historically, how is this affected Bitcoin? Yeah, well, it’s interesting because, you know, last, last cycle, Bitcoin actually popped off when the Fed reached the terminal rate.

So, if you were to go look at at United States interest rates and just sort of overlay it over the price of Bitcoin, I’m sure you distinctly remember December 2018, you know, with the probably the 10th time that Bitcoin had died.

And what’s interesting is that that corresponded to the bottom of Bitcoin, right, when they when they when the Fed reached the terminal rate is when it corresponded to the bottom.

But what’s more interesting is if you remember that rally in 2019, the rate cuts corresponded to Bitcoin going back down, which I think a lot of people assume that a rate cut is always immediately positive thing.

It’s a positive thing, like, you know, six to 12 months out right but it’s not an immediately positive thing right when it happens typically.

But that’s something that I think is worthwhile. The reason why this cycle I think you could argue that this cycle is is playing out in a in a different manner here you can see that Bitcoin at least reached this bottom on in November.

So there’s two arguments here means either Bitcoin hasn’t bottomed or it’s playing out a completely different way.

One, one potential way to view this is to treat if you remember when they were going 75 basis points 75 basis points, right, they did it four times in a row.

When they cut it down to 50?

Some people have interpreted that as the pivot.

And, and, and, and one of the things about the Fed is if they’ve been so far behind the curve. So my, my expectation is honestly is that Bitcoin will likely, you know, it can continue a bit higher from here.

Like that is certainly possible. We always have to leave potential room for the upside for Bitcoin. I think right now it’s between 27 and 28 K.

But I think as we get further on into the into the rate hiking cycle or at least, you know, after, especially when it gets to the point of cutting rates, I think we’re going to come back, come back in and come back down again.

And, and the reason I say that is, is not because I’m anti Bitcoin. I’m very pro Bitcoin and I’ve been talking about, you know, the dominance needs to go higher for a long time, because it’s much more valuable.

And I think that’s a lot of the other things that we all coins, especially given the uncertainty. But I think the issue is that we still have to go through this phase, right, of, of pausing and cutting.

And until we get through that phase, I think it would be premature for us to assume that this is the rally that takes Bitcoin and new highs.

So I think what we’re going to see is Bitcoin, you know, it’s been maybe a little bit of time back up here. Come back in the second half of the year and, and get one more scare, maybe in the third quarter of the year, maybe the fourth quarter at the latest.

And then, and then from there, I think we go into the into the next bull market where we could theoretically see new highs, but I think that’s going to be reserved for 2024 2025 timeframe.

And, and information based on everything we just discussed. How should you and I prepare?

I think that everyone’s happy right now because, of course, the price is going up. I think what we’re going to see is we’re going to see the same thing happen again, like we saw in 2015, 2019. I think Bitcoin will come back down later on this year.

It’s going to scare a lot of people, but I think it’s going to be a fairly normal thing. And it’s just going to be to scare to sort of get people to capitulate just before we get into the next having.

And just before we get back into quantitative easing. You’re right. Bitcoin has never really experienced interest rates this high, but we also know that the feds not going to be able to continue to hike forever.

So once we get back to quantitative easing, once we get back to lower interest rates, which I think will come, you know, by 2024 at the latest.

I think that’s your, your, really your bull case for Bitcoin. And not only that, I mean, just look at what’s happened with banks recently.

That’s another bull case, I think, for Bitcoin. So right now, my best explanation for, you know, for what’s going on with Bitcoin, I think, and I think this is reflected in the dominance.

I think there’s a lot of liquidity flow from the altcoin market back to Bitcoin. I think that’s what’s going on right now. And it’s sending Bitcoin higher.

But the trick with this is what happens when, you know, the altcoin liquidity dries up and can no longer support that.

I think that’s when Bitcoin comes back down and we get that scare. We go into 2024 with our rally caps on.

Now, Ben doesn’t admit that the one thing that would change his mind about his bearish take currently in the markets is if the Fed starts printing again actively.

That’s the thing that would make him turn into a bull sooner. But make sure you hit subscribe because I have one more interview dropping with Ben Cowan just on altcoins.

His top three picks, Bitcoin dominance, how long will altcoins continue to drain into Bitcoin dropping very, very soon.