What Silicon Valley Bank Collapse Means For Crypto |USDC Depeg

Will crypto recover? Is USDC safe? Let’s discuss the latest cryptocurrency news for bitcoin, Ethereum, altcoins, & MORE! SLAP THE LIKE BUTTON!

And there will be a catastrophic this national security issue because this is a lot bigger this will splash across all of the economy in the last 24 hours us DC the second most popular stablecoin and the fifth most popular cryptocurrency in the world lost its peg. And while technically it’s still operational just under its peg major crypto exchanges like Coinbase like Binance like Robinhood have all halted trading at least till Monday. There’re so many crypto channels out there just spreading fear just spreading FUD today. I want to go over the facts.

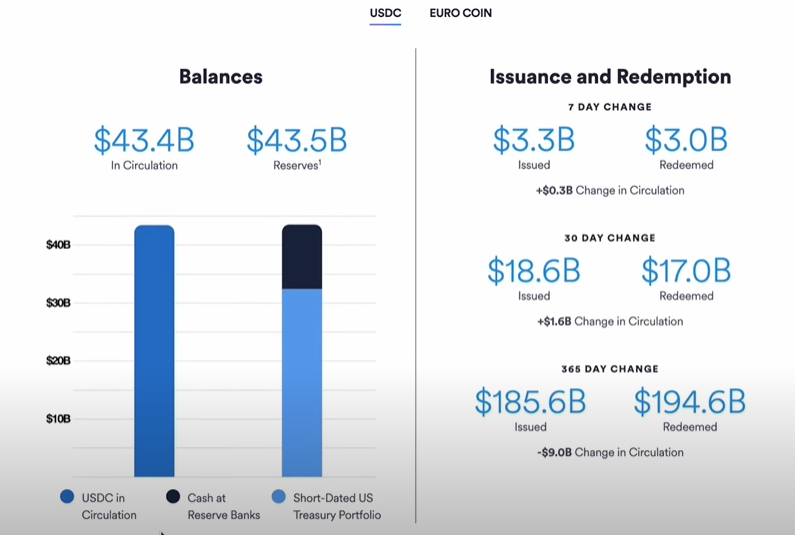

Take a look at what backs us DC as well as what this really means to you and me as crypto investors stablecoin firm circle reveals a 3.3-billion-dollar exposure to Silicon Valley Bank for a beginners guide on what is Silicon Valley Bank and what happened check out yesterday’s video linked down below largest US bank failure just like 2008. But essentially there is a bank run the bank didn’t have enough cash on hand so it imploded and now it’s been taken over by the FDIC and now all these small businesses that were banking with them. They now don’t even have the money to make payroll next week.

You know I have companies that are calling me saying how am I going to make payroll all of the legitimate cash that I was using to plan out my plan to be able to even just run the business. You know was in a bank account that I do not have access to anymore. We don’t know what’s going to happen to the law the depositors long term. But what I can say is that these thousands of currently small businesses that would become big drivers of GDP in the United States over the next 10 years they’re never going to get a chance actually to be that in the future. And that will be to the detriment of thousands of jobs if not tens of thousands of jobs in the future. These depositors will not survive survive you know weeks or months.

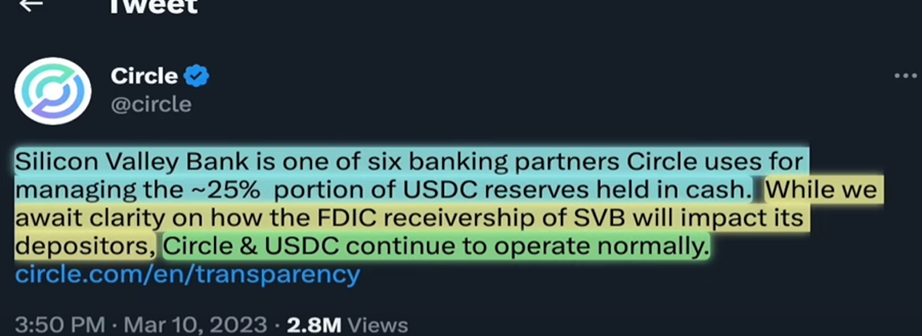

And of course, after Silicon Valley Bank collapsed circle the company behind USDC very open came out and delivered a statement. Silicon Valley Bank is one of six banking partners circle uses for managing the approximately 25% portion of USDC reserves held in cash. While we await clarity on how the FDIC receivership of Silicon Valley Bank will impact its depositors circle and USDC continue to operate normally. Of course hours after that late last night USDC stablecoin lost its peg for the first time in history. So yes it’s still operating but it sure as hell not operating normally. And as stated very clearly by circle USDC is not 100% backed by cash. USDC actually only has 25% of its backing held in cash the rest is in other financial products.

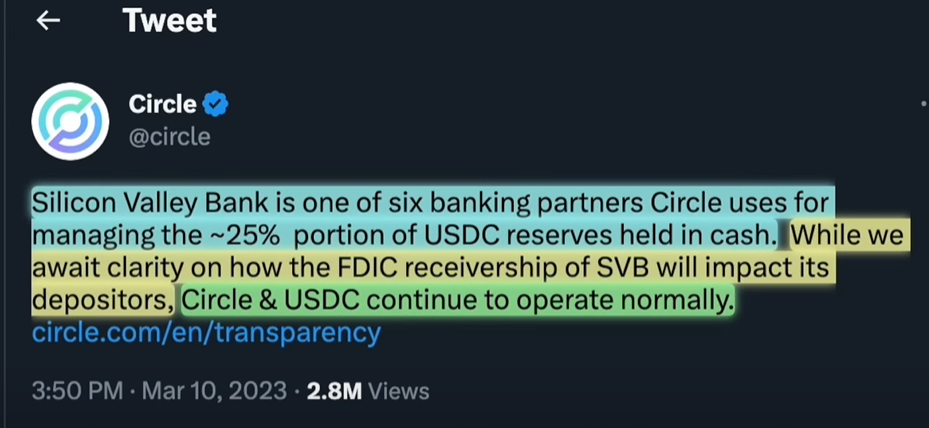

That’s why USDC is always redeemable one to one for US dollars and your coin is always redeemable one to one for euros. Always. And this is the exact breakdown of what exactly backs USDC stablecoin as of March 9th 2023. So this is the USDC in circulation and this is what backs that USDC. We can see while it’s the same value amount this black is actually the 25% cash reserves and then it’s back 75% in short dated US treasury portfolio. And again we can go into specifics circle reserve fund. Most other channels aren’t sharing this with you but I will here are the portfolio characteristics of all the backing that’s not cash.

And what’s important to me in this is we can see the final maturity dates many maturing in these next 30 to 90 days. Now I wish it was just purely backed one to one meaning for every stablecoin you issue let’s have one real dollar in the bank. And I do want to be clear that one of the silver linings in all this is that Silicon Valley bank was just one of six banking partners for circle and they did not lose all 25% of their cash reserves.

It was just 3.3 billion that was held in that bank and going that extra step doing some quick math on this. If they had around 43.5 billion dollars in total backing USDC, they potentially lost 3.3 billion. If you do the math just like this that’s around 7.5% of the total supply USDC coin is down about 7%. Actually 6% as of now 94 cents on the dollar means it’s down 6% so the math checks out. Now we just got a major update as I’m recording this video this just got released from circles chief strategy officer slash head of global policy.

We are hopeful that the FDIC as receiver will seek a rapid purchase and assumption of a franchise as strong as Silicon Valley banks to ensure all depositors are made whole. Now what if the FDIC doesn’t make people whole. It’s also possible that SVB Silicon Valley bank may not return 100% and also that any return may take some time as the FDIC issues IOUs and advanced dividends to the deposit holders. If that were to happen in this case circle as required by law under stored value money transmission regulation will stand behind USDC and cover any shortfalls using corporate resources involving external capital if necessary. So they’re essentially saying that any USDC in circulation if the FDIC doesn’t handle this circle will make sure everyone is backed one-to-one.

As a crypto investor, I have probably two choices. If I don’t think this is going to recover I could sell right now and 94 cents on the dollar or if I think it’ll repay if I think circle will get their crap together I can hold and wait for the repacking. Now of course if you keep your money on a centralized exchange that choice has been made for you but because of all this because of the Silicon Valley bank implosion many notable people are now calling for a bailout.

Powell is testifying in front of the banking committee and they asked him do you see any systemic risk in the banking system because of the rapid rise in interest rates he said no no systemic risk and Yellen put out a statement today Jake Al just to finish the thought that they’re monitoring the situation.

Great episode great breakdown. And of course this is an ongoing story the minute I get new information I will make a video I’ll keep you updated. And if you’re trying to come out and hang in the LA area the bring a friend special pricing for tickets does end in two days. We use code altcoin daily VIP linked down below that ones in California this one is in Miami Beach May 18th through 20th come out Bitcoin 2023 use code altcoin daily for 10% off your ticket.